Regulation Zone

Powered by:

Featured Initiatives

Regulation Stage

-

Securing the digital economy against modern risk & governance challenges

-

RegTech & SupTech

-

Policy frameworks & cross-border collaboration

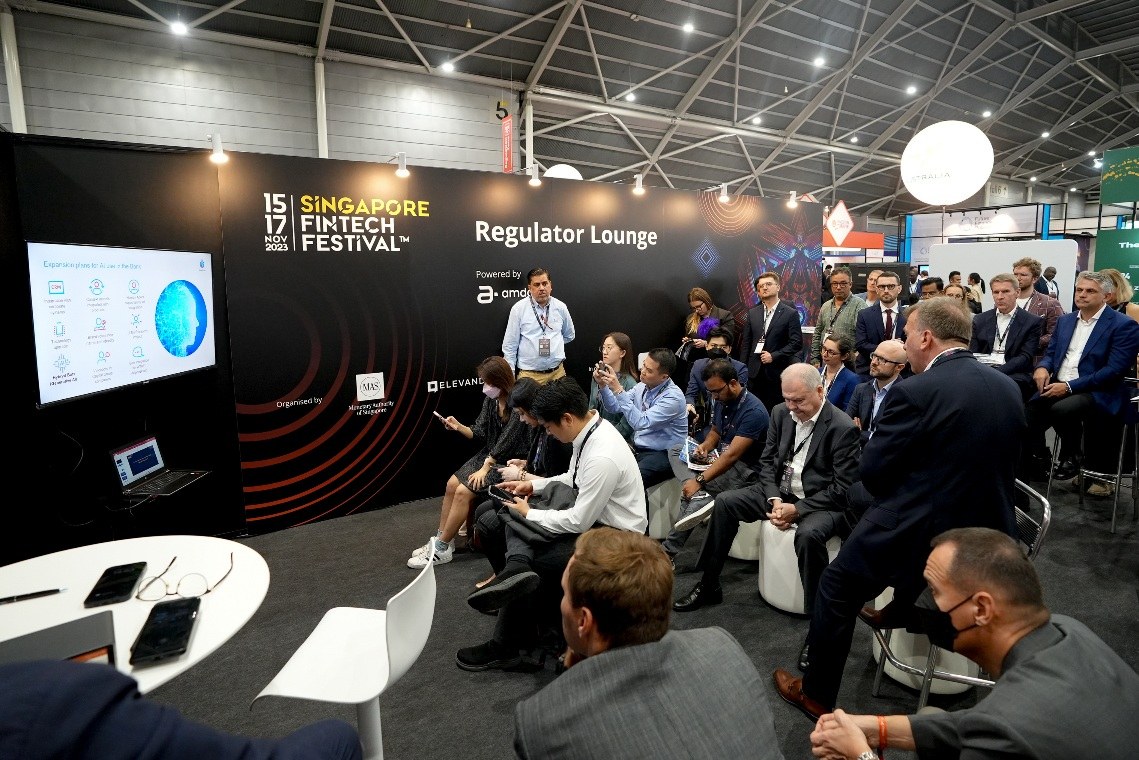

Regulators Lounge

Zone Attendees

FINANCIAL REGULATORS

POLICYMAKERS

FINTECH EXECUTIVES

LEGAL PROFESSIONALS

REGTECH & SUPTECH STARTUPS

RISK & COMPLIANCE OFFICERS

BANKING & FINANCE PROFESSIONALS

ACADEMICS & RESEARCHERS

2023 Regulation Stage Featured Speakers

-

Alessandra Perrazzelli

Deputy Governor

Bank of Italy

Alessandra Perrazzelli

Deputy Governor

- Deputy Governor of the Bank of Italy and Member of the ECB SSM Supervisory Board.

- She was previously Italy Country Manager for Barclays Bank and, before that, Head of International Regulatory & Antitrust Affairs for Intesa Sanpaolo Bank.

- Member of the New York State Bar.

- Founder and chair of Valore D, an association fostering women’s talent in leading roles.

- Law degree from Genoa University and Master of Laws from New York University.

- Executive MBA from Stanford University.

- Awarded with a Knighthood in the Order of the Merit of the Italian Republic. -

Camilla Bullock

Chief Executive Officer

Emerging Payments Association Asia

Camilla Bullock

Chief Executive Officer

Camilla is the CEO of Emerging Payments Association Asia. Her role is to bring together the different participants in the value chain of payments for collaboration. The core of the EPAA activities is policy and advocacy to enhance the industry. Camilla has a long career in the financial technology industry, starting in London in early 2000 working for Reuters (today LSEG) and often talks about coming home when she started her work in the payments industry. Payments is the part of the financial service that touches people's lives every day, and through EPA Asia work lives can be improved. The payments industry offered her an opportunity to combine her passion for fintech and humanitarian questions.

-

Deborah Young

Chief Executive Officer

The RegTech Association

Deborah Young

Chief Executive Officer

Deborah Young is the founding CEO of The RegTech Association, a global non-profit industry member body focussed on accelerating adoption of RegTech solutions and creating a global centre of excellence. Since helping to establish the Association in 2017, she has led the growth to 170 organisations. The cohort includes top tier banks, global technology companies and consulting firms. She has advocated for the industry with Government, regulators, investors and trade agencies. Deborah is a sought-after leader and advisor on the global RegTech industry, a regular speaker, presenter and designer of RegTech programs and engages with regulators globally. Deborah is driving the Association’s global market program. She is member of Chief Executive Women, a member of the Australian Securities and Investments Commission (ASIC) Digital Panel, she sits on the global advisory committee of Women in Regulatory Innovation and on the Alliance for Innovative Regulation Global Advisory Council and Griffith University Advisory Board Member for their Academy of Excellence in Financial Crime Investigation and Compliance. Deborah is an accomplished chief executive, non-executive director, mentor and strategic business consultant. She is a passionate diversity advocate and volunteers for a human rights organisation to limit food waste and provide food to those in need. She has over 30 years' experience as a senior executive across financial services, including investment banking, private equity, venture capital, superannuation and insurance spectrums. Deborah holds an Executive MBA (Global) from UTS Business School and was named as one of the Australian Financial Review’s 100 Women of Influence in 2019 for Innovation.

-

Emma Butterworth

Head of Innovation & Payments Policy

Bank of England

Emma Butterworth

Head of Innovation & Payments Policy

Emma Butterworth is responsible for developing domestic and international policy in relation to traditional payment systems as well as more innovative forms of payment and settlement, including stablecoins and the FMI sandbox Emma has 20 years of experience across a wide range of policy roles at the Bank of England. Prior to her current role, Emma worked in the Bank of England's financial stability area and supported the establishment of the Bank's Financial Policy Committee. Emma holds undergraduate and postgraduate degrees in economics from Durham University and University College London.

-

François Villeroy De Galhau (virtual)

Governor

Banque de France

François Villeroy De Galhau (virtual)

Governor

1959

Naissance à Strasbourg

1997

Head of Cabinet, French Ministry of Finance

2000

General Manager Tax department, French Ministry of Finance

2003

CEO Cetelem

2011

Deputy General Manager BNP Paribas Group

2015

Governor of Banque de France -

Jean-Paul Servais

Chair IOSCO and Chairman FSMA

IOSCO & FSMA

Jean-Paul Servais

Chair IOSCO and Chairman FSMA

Since October 2022, Jean-Paul Servais is the Chairman of the board of the International Organization of Securities Commissions (IOSCO). IOSCO is the membership organization composed of the world’s financial markets regulators involved in the supervision of 95 % of the financial sector at international level. He is also the Chairman of the IOSCO European Regional Committee

Jean-Paul Servais is the first Belgian to be elected Chairman of IOSCO. His election was partly in recognition of his efforts and the quality of his work during the six years in which he was already vice-chairman of IOSCO. As IOSCO Chairman, he helped bring about major international breakthroughs in the regulation of crypto currencies and in introducing reporting standards on sustainability.

Between 2017 and 2023, Mr. Servais chaired the IFRS Foundation Monitoring Board, which consists of global financial regulators and provides oversight to the IFRS Foundation. In parallel, he was the co-chair of the Monitoring Group (2021-2023), a group of international financial institutions and regulatory bodies committed to advancing the public interest in areas related to international audit standard setting and audit quality. Within IOSCO, Jean-Paul also led the SPAC network, which successfully delivered a final report in May 2023.

Besides his international responsibilities, Mr Servais is the Chairman of the Belgian Financial Services and Markets Authority (FSMA). In this capacity, he is a board member of other international supervisory bodies for the financial sector such as the European Securities and Markets Authority (ESMA), and the European Systemic Risk Board (ESRB). Besides, he sits on a number of supervisory colleges that coordinate the (cross-border) supervision of financial institutions and infrastructures.

Through these experiences Jean-Paul has accrued a unique blend of supervisory expertise and regulatory acumen in the field of international financial services. Jean-Paul is known for his commitment towards investor protection. Beyond his thorough understanding on the functioning of traditional financial services and markets, Jean-Paul is an engaged and influential figure on sustainable finance and digital regulatory agendas.

Also based on his experiences as a supervisor and from his passion for education, Jean-Paul Servais had become imbued with the importance of financial education. He therefore requested and obtained from the Belgian legislator the power for the FSMA to contribute to the financial education of the population. Under his impetus, the FSMA launched in 2013 the now very successful Wikifin financial education programme. And in 2020, the Wikifin Lab opened in Brussels. This unique centre for financial education has since welcomed thousands of Belgian students and has become a reference at international level.

Jean-Paul teaches at the Université Libre de Bruxelles (ULB, University of Brussels), where he is part-time professor in International Business Law and in the specialised Master in Tax Law. He is author or co-author of more than 500 contributions, mostly engaging on European and international systems of financial supervision and regulation issues. -

Joachim Wuermeling

Member of the Executive Board

Deutsche Bundesbank

Joachim Wuermeling

Member of the Executive Board

Prof. Dr. Joachim Wuermeling took office as a member of the Executive Board of the Deutsche Bundesbank on November 1, 2016. He is responsible for the Directorates General Data and Statistics, Controlling, Accounting and Organisation as well as Information Technology and Risk Control. Prior to taking on his current position, Mr. Wuermeling, who has a PhD in Law, held a variety of executive-level posts in the financial and insurance industries as well as in politics. From 2011 until his departure for the Bundesbank, Mr. Wuermeling was Chairman of the Board of Directors of the Association of Sparda-Banken in Frankfurt am Main. Prior to that, he was a member of the Executive Board of the German Insurance Association for around three years. From 2005 to 2008, Mr. Wuermeling was State Secretary for European affairs at the Federal Ministry for Economics and Technology, where he was also responsible for coordinating European policy matters. Prior to this, he was a member of the European Parliament (CSU) from 1999 to 2005.

-

.png?width=280&height=280&name=Matthew%20Long%20(1).png)

Matthew Long

Director

Financial Conduct Authority (FCA)

Matthew Long

Director

Matthew joined the FCA as the new Director of Payments & Digital Assets in October 2022. In his role, Matthew is responsible for Market Interventions, Market Analysis and Policy across the

Payments and Digital Asset Portfolios. In addition, Matthew continues the FCA’s leadership in international crypto initiatives as the Lead of the IOSCO Fintech Taskforce Crypto and Digital Assets Working Group.

Matthew is the former Director of the National Economic Crime Command within the National Crime Agency (NCA). His responsibilities included leading the multi-agency National Economic Crime Centre which has a strategic UK system leadership role for economic crime and illicit finance. He also led the UK Financial Intelligence Unit (UKFIU) which has national responsibility for receiving, analysing and disseminating financial intelligence submitted through the Suspicious Activity Reports Regime. At the NCA, he has driven the public-private partnership with financial services to find solutions for government and industry problems together, most recently with a Crypto Summit. Matthew works to balance risks and opportunity of innovation and has carried this into his role at the FCA.

Operationally, he is a multi-agency Commander with extensive experience in leading international initiatives and collaboration, including through his work with Interpol, Europol and international roundtables on serious and organised crime. Prior to this, Matthew was leading the response to Organised Immigration Crime, Modern Slavery and Human Trafficking, Drugs, Firearms, Borders and the programme to build the National Data Exploitation Capability. Matthew’s career began as a detective in Kent Police where he qualified as Senior Investigating Officer (SIO) having led over 400 investigations, including a number of high profile child abuse operations.

He is proud of his international collaboration in both illicit finance and child exploitation delivering both operational and policy results. He received national and international awards for his investigations and innovation.

Matthew holds a PhD in Risk Management and has been part of a team creating worldwide child abuse risk assessments. In his academic life he is currently working on applying child abuse risk models to terrorism. -

Mona Zoet

Founder & Chief Executive Officer

RegPac Revolution

Mona Zoet

Founder & Chief Executive Officer

Mona Zoet, founder and CEO of RegPac Revolution, has over 20 years of experience in the Financial Services Industry within the Legal, Risk, and Compliance areas of top-tier Financial Institutions around the globe before becoming an entrepreneur. She started RegPac Revolution more than five years ago to build an ecosystem collaborating with public/private and connecting the dots globally. RegPac also educates and advises about Regulatory Technology (RegTech) and helps startups scale and expand into SEA. Mona is a frequent guest speaker at several conferences in Asia and globally and she holds various RegTech Committee Memberships (SFA, IRTA). She furthermore is a mentor for multiple entrepreneurial(Tech) projects, and is a nonexecutive board member for a couple of companies within the GRC space. More recently, Mona has been eager to create more advocacy about impactful risk management and sustainability awareness and is very keen to assist in accelerating ESG adoption on a global scale. She has contributed to several publications, including “The Legal Aspects of Blockchain,” a book published by the UNOPS focusing on the legal implications that blockchain can unlock. Mona furthermore shares co authorship for the books #RegTech Blackbook and #RegTech Blackbook “The Sequel,” which highlights all the latest developments in RegTech. And Mona has been mentioned as one of the RegTech top 100 influencers, according to a report created by Analytica One.

-

Ndungu Thairu

Deputy Managing Director

Consolidated Bank Ghana Limited

Ndungu Thairu

Deputy Managing Director

Thairu Ndungu is Deputy Managing Director of Consolidated Bank Ghana.

He has over thirty years’ experience in the Financial Markets. He worked at Nubuke Investments LLP, London in the UK for twelve years as Partner and Chief Operating officer.

Prior to that he was working for Standard Chartered Bank in their Africa Regional Office based in London, UK. He worked for Standard Chartered for sixteen years, in various roles and countries in Africa, UK, Middle East and Asia. The last role being Regional Head, Markets Operations-Africa based in London and briefly in Dubai.

He has extensive experience in general management, investment management, risk management, project management and process change management.

Thairu has a BSC in Mathematics and Post Graduate Diploma in Computer Science both from the University of Nairobi, Kenya. -

Valerie Szczepanik

Director, US SEC FinHub

US Securities and Exchange Commission

Valerie Szczepanik

Director, US SEC FinHub

Valerie A. Szczepanik is the Director of the Strategic Hub for Innovation and Financial Technology (FinHub) Office at the U.S. Securities and Exchange Commission. Ms. Szczepanik also served as a Special Assistant United States Attorney at the United States Attorney’s Office for the Eastern District of New York. She clerked for federal judges on the United States District Court for the District of Columbia and the United States Court of Appeals for the Federal Circuit and, prior to clerking, practiced patent law. Ms. Szczepanik received her Juris Doctor degree from Georgetown University and her Bachelor of Science degree in Engineering from the University of Pennsylvania.

Alessandra Perrazzelli

Deputy Governor

Bank of Italy

- Deputy Governor of the Bank of Italy and Member of the ECB SSM Supervisory Board.

- She was previously Italy Country Manager for Barclays Bank and, before that, Head of International Regulatory & Antitrust Affairs for Intesa Sanpaolo Bank.

- Member of the New York State Bar.

- Founder and chair of Valore D, an association fostering women’s talent in leading roles.

- Law degree from Genoa University and Master of Laws from New York University.

- Executive MBA from Stanford University.

- Awarded with a Knighthood in the Order of the Merit of the Italian Republic.

Camilla Bullock

Chief Executive Officer

Emerging Payments Association Asia

Camilla is the CEO of Emerging Payments Association Asia. Her role is to bring together the different participants in the value chain of payments for collaboration. The core of the EPAA activities is policy and advocacy to enhance the industry. Camilla has a long career in the financial technology industry, starting in London in early 2000 working for Reuters (today LSEG) and often talks about coming home when she started her work in the payments industry. Payments is the part of the financial service that touches people's lives every day, and through EPA Asia work lives can be improved. The payments industry offered her an opportunity to combine her passion for fintech and humanitarian questions.

Deborah Young

Chief Executive Officer

The RegTech Association

Deborah Young is the founding CEO of The RegTech Association, a global non-profit industry member body focussed on accelerating adoption of RegTech solutions and creating a global centre of excellence. Since helping to establish the Association in 2017, she has led the growth to 170 organisations. The cohort includes top tier banks, global technology companies and consulting firms. She has advocated for the industry with Government, regulators, investors and trade agencies. Deborah is a sought-after leader and advisor on the global RegTech industry, a regular speaker, presenter and designer of RegTech programs and engages with regulators globally. Deborah is driving the Association’s global market program. She is member of Chief Executive Women, a member of the Australian Securities and Investments Commission (ASIC) Digital Panel, she sits on the global advisory committee of Women in Regulatory Innovation and on the Alliance for Innovative Regulation Global Advisory Council and Griffith University Advisory Board Member for their Academy of Excellence in Financial Crime Investigation and Compliance. Deborah is an accomplished chief executive, non-executive director, mentor and strategic business consultant. She is a passionate diversity advocate and volunteers for a human rights organisation to limit food waste and provide food to those in need. She has over 30 years' experience as a senior executive across financial services, including investment banking, private equity, venture capital, superannuation and insurance spectrums. Deborah holds an Executive MBA (Global) from UTS Business School and was named as one of the Australian Financial Review’s 100 Women of Influence in 2019 for Innovation.

Emma Butterworth

Head of Innovation & Payments Policy

Bank of England

Emma Butterworth is responsible for developing domestic and international policy in relation to traditional payment systems as well as more innovative forms of payment and settlement, including stablecoins and the FMI sandbox Emma has 20 years of experience across a wide range of policy roles at the Bank of England. Prior to her current role, Emma worked in the Bank of England's financial stability area and supported the establishment of the Bank's Financial Policy Committee. Emma holds undergraduate and postgraduate degrees in economics from Durham University and University College London.

François Villeroy De Galhau (virtual)

Governor

Banque de France

1959

Naissance à Strasbourg

1997

Head of Cabinet, French Ministry of Finance

2000

General Manager Tax department, French Ministry of Finance

2003

CEO Cetelem

2011

Deputy General Manager BNP Paribas Group

2015

Governor of Banque de France

Jean-Paul Servais

Chair IOSCO and Chairman FSMA

IOSCO & FSMA

Since October 2022, Jean-Paul Servais is the Chairman of the board of the International Organization of Securities Commissions (IOSCO). IOSCO is the membership organization composed of the world’s financial markets regulators involved in the supervision of 95 % of the financial sector at international level. He is also the Chairman of the IOSCO European Regional Committee

Jean-Paul Servais is the first Belgian to be elected Chairman of IOSCO. His election was partly in recognition of his efforts and the quality of his work during the six years in which he was already vice-chairman of IOSCO. As IOSCO Chairman, he helped bring about major international breakthroughs in the regulation of crypto currencies and in introducing reporting standards on sustainability.

Between 2017 and 2023, Mr. Servais chaired the IFRS Foundation Monitoring Board, which consists of global financial regulators and provides oversight to the IFRS Foundation. In parallel, he was the co-chair of the Monitoring Group (2021-2023), a group of international financial institutions and regulatory bodies committed to advancing the public interest in areas related to international audit standard setting and audit quality. Within IOSCO, Jean-Paul also led the SPAC network, which successfully delivered a final report in May 2023.

Besides his international responsibilities, Mr Servais is the Chairman of the Belgian Financial Services and Markets Authority (FSMA). In this capacity, he is a board member of other international supervisory bodies for the financial sector such as the European Securities and Markets Authority (ESMA), and the European Systemic Risk Board (ESRB). Besides, he sits on a number of supervisory colleges that coordinate the (cross-border) supervision of financial institutions and infrastructures.

Through these experiences Jean-Paul has accrued a unique blend of supervisory expertise and regulatory acumen in the field of international financial services. Jean-Paul is known for his commitment towards investor protection. Beyond his thorough understanding on the functioning of traditional financial services and markets, Jean-Paul is an engaged and influential figure on sustainable finance and digital regulatory agendas.

Also based on his experiences as a supervisor and from his passion for education, Jean-Paul Servais had become imbued with the importance of financial education. He therefore requested and obtained from the Belgian legislator the power for the FSMA to contribute to the financial education of the population. Under his impetus, the FSMA launched in 2013 the now very successful Wikifin financial education programme. And in 2020, the Wikifin Lab opened in Brussels. This unique centre for financial education has since welcomed thousands of Belgian students and has become a reference at international level.

Jean-Paul teaches at the Université Libre de Bruxelles (ULB, University of Brussels), where he is part-time professor in International Business Law and in the specialised Master in Tax Law. He is author or co-author of more than 500 contributions, mostly engaging on European and international systems of financial supervision and regulation issues.

Joachim Wuermeling

Member of the Executive Board

Deutsche Bundesbank

Prof. Dr. Joachim Wuermeling took office as a member of the Executive Board of the Deutsche Bundesbank on November 1, 2016. He is responsible for the Directorates General Data and Statistics, Controlling, Accounting and Organisation as well as Information Technology and Risk Control. Prior to taking on his current position, Mr. Wuermeling, who has a PhD in Law, held a variety of executive-level posts in the financial and insurance industries as well as in politics. From 2011 until his departure for the Bundesbank, Mr. Wuermeling was Chairman of the Board of Directors of the Association of Sparda-Banken in Frankfurt am Main. Prior to that, he was a member of the Executive Board of the German Insurance Association for around three years. From 2005 to 2008, Mr. Wuermeling was State Secretary for European affairs at the Federal Ministry for Economics and Technology, where he was also responsible for coordinating European policy matters. Prior to this, he was a member of the European Parliament (CSU) from 1999 to 2005.

.png?width=280&height=280&name=Matthew%20Long%20(1).png)

Matthew Long

Director

Financial Conduct Authority (FCA)

Matthew joined the FCA as the new Director of Payments & Digital Assets in October 2022. In his role, Matthew is responsible for Market Interventions, Market Analysis and Policy across the

Payments and Digital Asset Portfolios. In addition, Matthew continues the FCA’s leadership in international crypto initiatives as the Lead of the IOSCO Fintech Taskforce Crypto and Digital Assets Working Group.

Matthew is the former Director of the National Economic Crime Command within the National Crime Agency (NCA). His responsibilities included leading the multi-agency National Economic Crime Centre which has a strategic UK system leadership role for economic crime and illicit finance. He also led the UK Financial Intelligence Unit (UKFIU) which has national responsibility for receiving, analysing and disseminating financial intelligence submitted through the Suspicious Activity Reports Regime. At the NCA, he has driven the public-private partnership with financial services to find solutions for government and industry problems together, most recently with a Crypto Summit. Matthew works to balance risks and opportunity of innovation and has carried this into his role at the FCA.

Operationally, he is a multi-agency Commander with extensive experience in leading international initiatives and collaboration, including through his work with Interpol, Europol and international roundtables on serious and organised crime. Prior to this, Matthew was leading the response to Organised Immigration Crime, Modern Slavery and Human Trafficking, Drugs, Firearms, Borders and the programme to build the National Data Exploitation Capability. Matthew’s career began as a detective in Kent Police where he qualified as Senior Investigating Officer (SIO) having led over 400 investigations, including a number of high profile child abuse operations.

He is proud of his international collaboration in both illicit finance and child exploitation delivering both operational and policy results. He received national and international awards for his investigations and innovation.

Matthew holds a PhD in Risk Management and has been part of a team creating worldwide child abuse risk assessments. In his academic life he is currently working on applying child abuse risk models to terrorism.

Mona Zoet

Founder & Chief Executive Officer

RegPac Revolution

Mona Zoet, founder and CEO of RegPac Revolution, has over 20 years of experience in the Financial Services Industry within the Legal, Risk, and Compliance areas of top-tier Financial Institutions around the globe before becoming an entrepreneur. She started RegPac Revolution more than five years ago to build an ecosystem collaborating with public/private and connecting the dots globally. RegPac also educates and advises about Regulatory Technology (RegTech) and helps startups scale and expand into SEA. Mona is a frequent guest speaker at several conferences in Asia and globally and she holds various RegTech Committee Memberships (SFA, IRTA). She furthermore is a mentor for multiple entrepreneurial(Tech) projects, and is a nonexecutive board member for a couple of companies within the GRC space. More recently, Mona has been eager to create more advocacy about impactful risk management and sustainability awareness and is very keen to assist in accelerating ESG adoption on a global scale. She has contributed to several publications, including “The Legal Aspects of Blockchain,” a book published by the UNOPS focusing on the legal implications that blockchain can unlock. Mona furthermore shares co authorship for the books #RegTech Blackbook and #RegTech Blackbook “The Sequel,” which highlights all the latest developments in RegTech. And Mona has been mentioned as one of the RegTech top 100 influencers, according to a report created by Analytica One.

Ndungu Thairu

Deputy Managing Director

Consolidated Bank Ghana Limited

Thairu Ndungu is Deputy Managing Director of Consolidated Bank Ghana.

He has over thirty years’ experience in the Financial Markets. He worked at Nubuke Investments LLP, London in the UK for twelve years as Partner and Chief Operating officer.

Prior to that he was working for Standard Chartered Bank in their Africa Regional Office based in London, UK. He worked for Standard Chartered for sixteen years, in various roles and countries in Africa, UK, Middle East and Asia. The last role being Regional Head, Markets Operations-Africa based in London and briefly in Dubai.

He has extensive experience in general management, investment management, risk management, project management and process change management.

Thairu has a BSC in Mathematics and Post Graduate Diploma in Computer Science both from the University of Nairobi, Kenya.

Valerie Szczepanik

Director, US SEC FinHub

US Securities and Exchange Commission

Valerie A. Szczepanik is the Director of the Strategic Hub for Innovation and Financial Technology (FinHub) Office at the U.S. Securities and Exchange Commission. Ms. Szczepanik also served as a Special Assistant United States Attorney at the United States Attorney’s Office for the Eastern District of New York. She clerked for federal judges on the United States District Court for the District of Columbia and the United States Court of Appeals for the Federal Circuit and, prior to clerking, practiced patent law. Ms. Szczepanik received her Juris Doctor degree from Georgetown University and her Bachelor of Science degree in Engineering from the University of Pennsylvania.

2023 Partners and Showcase

.png?width=400&height=200&name=BANK%20OF%20CANADA%20-REGULATION%20(1).png)

national%20bank%20of%20georgia%20.png?width=400&height=200&name=(regulation)national%20bank%20of%20georgia%20.png)

.png?width=400&height=200&name=regtank%20(REGULATION%20ZONE).png)

.png?width=400&height=200&name=amdocs%20silver%20(new).png)

FINANCIAL CONSULTANTS & ADVISORS

ESG FINTECH

BUSINESS EXECUTIVES

COMPANY CSOS

The Festival

Get Involved

Global Platforms