Talent Zone: Advancing careers in FinTech

Upskill, Get Certified, Connect with Mentors, Meet Recruiters

Featured Initiatives

Talent Pavilion

In the signature Talent Pavilion this year, aspiring and mid-career professionals can:

- Explore talent development initiatives including learning resources, training schemes, internship and job opportunities

- Pick up a new FinTech skill in any of its 16 academic workshops on AI, Web3.0, Blockchain and Data Science conducted by Polytechnics, Universities and leading FinTech firms

Learning Village

Take control of your own future. At the Learning Village, explore reskilling and upskilling programmes offered by education institutions and training providers.

Equip yourself with the capabilities for new careers and update your skills to stay relevant and competitive.

Talent Stage

The dedicated stage for thought leadership on the future of jobs and skills. Key sessions include:

- FinTech talent report 2023: Trends, challenges and opportunities for the year ahead

- Career opportunities for today's youth

- Brave new world: Building a future-proof skill set

Hackathon Demo Days

Get inspired by innovative FinTech projects. and meet with gifted FinTech talent at the Talent Zone.

The Talent Stage will host the demo days of:

- Global FinTech Hackcelerator

- PolyFintech100 Hackathon

- Project Showcase: F' In Tech Innov[ai]te

- CODERHACKx 2023

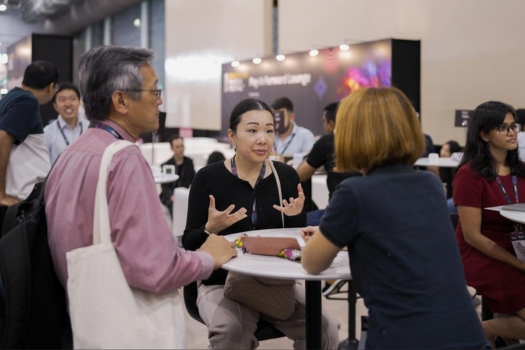

Pay it Forward Lounge

Students, young and mid-career professionals can receive 1:1 mentorship from industry veterans, receive career coaching by IBF and participate in resume clinics conducted by NTUC e2i to supercharge their careers.

Certifications

Asia Institute of Digital Finance, National University of Singapore

SMU Academy, Singapore Management University

S P Jain School of Global Management

FinTech Jobs

They enable the connection of skilled candidates opportunities with the biggest employers. Get the vital edge you need to maximize your career.

SFF 2024 Programmes

Blockchain Guardians Programme

.jpg?width=2000&height=1047&name=ee_blockchainguardian_web_img_1%20(1).jpg)

The Blockchain Guardians Programme1 is an intensive 10-week talent development programme, comprising an online certificate programme, mentorship and industry immersion.

✔ Deepen your knowledge in digital assets and develop a robust compliance mindset

✔ Gain hands-on experience with tools used in the blockchain investigations and compliance

✔ Be paired with industry leaders and seasoned professionals as mentors

✔ Build and expand your professional network

[1] The Blockchain Guardians Programme is a programme by Elevandi and its partners. The Blockchain Guardians Programme and its certificate programme is neither endorsed by the Monetary Authority of Singapore(MAS) nor affiliated with MAS’ Project Guardian.

Pay it Forward Mentorship Programme

Students early and mid-career professionals can receive 1:1 mentorship from industry veterans to learn more about careers in:

1. Product and Project Management

2. Governance, Risk and Compliance

3. AI & Data

4. Web3 Builders

5. Impact Careers (ESG)

6. Communities, Partnerships and Ecosystems

In addition, IBF and e2i will be conducting career coaching clinics daily at the Pay it

Forward Lounge.

Pay it Forward Key Dates:

- Mentor registration period: Now – 30 Sep

- Review of mentors: 30 Sep – 17 Oct

- Confirmation of mentors: 18 Oct

- Mentorship meeting booking period: 18 Oct – 5 Nov

Earn a Certificate

.jpg?width=2000&name=shutterstock_622231379%20(1).jpg)

Enrich your understanding of the key topics in FinTech and Finance discussed at the Singapore FinTech Festival by earning a certificate offered by our university and professional development partners.

- Postgraduate Certificate Banking and FinTech by LIBF*

- Postgraduate Certificate Banking and Sustainable Finance by LIBF*

- Leadership in the Future of Finance by BondbloX

- Cambridge Digital Assets for Enterprise by CCAF

- Rearchitecting the Financial System by CFTE and Elevandi Education

- AI Governance Executive Programme in Global Capital Markets by AIDF

*Subsidies available through the SFF-LIBF Scholarship

FinTech Jobs

They enable the connection of skilled candidates' opportunities with the biggest employers. Get the vital edge you need to maximize your career.

Talent Stage Featured Speakers

-

Ajay Banga

President

World Bank

Ajay Banga

President

Ajay Banga began his five-year term as World Bank President on June 2, 2023.

Immediately before, Ajay served as Vice Chairman at General Atlantic and previously was President and CEO of Mastercard. Under his leadership, MasterCard launched the Center for Inclusive Growth, which advances equitable and sustainable economic growth and financial inclusion around the world.

Ajay was Honorary Chairman of the International Chamber of Commerce from 2020-2022. And served as advisor to General Atlantic’s climate-focused fund, BeyondNetZero, at its inception in 2021.

Additionally, Ajay Co-Chaired the Partnership for Central America, a coalition of private organizations that works to advance economic opportunity across underserved populations in El Salvador, Guatemala, and Honduras. He also served on the Boards of the American Red Cross, Kraft Foods, and Dow Inc.

Ajay is a co-founder of The Cyber Readiness Institute and was Vice Chair of the Economic Club of New York. He was awarded the Foreign Policy Association Medal in 2012, the Padma Shri Award by the President of India in 2016, the Ellis Island Medal of Honor and the Business Council for International Understanding’s Global Leadership Award in 2019, and the Distinguished Friends of Singapore Public Service Star in 2021.

-

Anil Wadhwani

Chief Executive Officer

Prudential plc

Anil Wadhwani

Chief Executive Officer

As Chief Executive Officer, Anil leads Prudential plc’s operations in Asia and Africa, overseeing a 15,000-strong team in 24 markets.

He joined Prudential in 2023 with a passion for helping customers, their families and communities secure their future through innovative solutions. Anil is based in Hong Kong.

Anil has more than 30 years’ financial services experience, predominantly in Asia. Born and educated in Mumbai, he has lived and worked in India, Singapore, London, New York and Hong Kong.

Prior to joining Prudential, Anil was CEO of Manulife Asia, where he spent five years growing the multi-channel organisation and transforming its highly diversified business with significant market share gains.

Anil also spent 25 years with Citigroup Inc in Asia Pacific, EMEA and the US in a number of consumer financial services roles.

Throughout his career Anil has combined strategic vision and meticulous execution to drive the performance of leading companies. He has also led significant digital transformation, having overseen the modernisation of technology platforms in previous roles.

Anil holds a Master’s Degree in Management Studies from the Somaiya Institute of Management Studies and a Bachelor’s Degree in Commerce from the Narsee Monjee College of Commerce and Economics in Mumbai.

-

Hon Caroline D. Pham

Commissioner

U.S. Commodity Futures Trading Commission

Hon Caroline D. Pham

Commissioner

The Honorable Caroline D. Pham was sworn in as a CFTC Commissioner on April 14, 2022. Commissioner Pham is a recognized leader in financial services compliance and regulatory strategy and policy. Her substantial experience spans key international issues such as prudential regulation and systemic risk, financial markets, fintech and digital assets, ESG, implementation of global regulatory reforms, and addressing the impact of major disruptions like the 2008 financial crisis and the COVID-19 pandemic. Commissioner Pham is the sponsor of the CFTC’s Global Markets Advisory Committee.

Previously, Commissioner Pham was a Managing Director at Citigroup where she held various senior roles, including Head of Market Structure for Strategic Initiatives on the Institutional Clients Group Business Development team; Head of Capital Markets Regulatory Strategy and Engagement; Deputy Head of Global Regulatory Affairs; and Global Head of Swap Dealer and Volcker Compliance. She was a member of firmwide governance forums and has held leadership roles in many industry organizations.

Commissioner Pham is a Fellow of the American Bar Foundation and has received various professional awards. She has a B.A. from UCLA and a J.D. from the George Washington University Law School, where she has served on the Dean’s Advisory Council for Business and Finance Law and was a Visiting Fellow at the Center for Law, Economics and Finance.

-

Professor Eswar Prasad

Professor

Cornell University

Professor Eswar Prasad

Professor

Eswar Prasad is the Tolani Senior Professor of Trade Policy and Professor of Economics at Cornell University. He is also a Senior Fellow at the Brookings Institution, where he holds the New Century Chair in International Economics, and a Research Associate at the National Bureau of Economic Research. He was previously chief of the Financial Studies Division in the IMF’s Research Department and, before that, was the head of the IMF’s China Division.

Prasad’s latest book is The Future of Money: How the Digital Revolution is Transforming Currencies and Finance (Harvard University Press, 2021), which was listed among the best economics books of 2021 by the Economist, the Financial Times and Foreign Affairs. He is also the author of Gaining Currency: The Rise of the Renminbi (Oxford, 2016) and The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global Finance (Princeton, 2014). Prasad has testified before the Senate Finance Committee, the House of Representatives Committee on Financial Services, and the U.S.-China Economic and Security Review Commission. He is the creator of the Brookings-Financial Times world economy index (TIGER: Tracking Indices for the Global Economic Recovery). His op-ed articles have appeared in the Financial Times, Foreign Policy, Harvard Business Review, New York Times, Wall Street Journal, and Washington Post.

-

François Villeroy de Galhau

Governor

Banque de France

François Villeroy de Galhau

Governor

1959 - Naissance à Strasbourg

1997 - Head of Cabinet, French Ministry of Finance

2000 - General Manager Tax Department, French Ministry of Finance

2003 - CEO Cetelem

2011 - Deputy General Manager BNP Paribas Group

2015 - Governor of Banque de France

-

Gintare Skaiste

Minister of Finance

Republic of Lithuania

Gintare Skaiste

Minister of Finance

Gintarė Skaiste is currently the Minister of Finance of the Republic of Lithuania. She is an economist with a PhD in Social Science.

The Magazine The Banker, a member of the Financial Times publication group, announced G. Skaistė to be the winner of the Finance Minister of the Year (2022) in global and European context. This honourable position is held by Mrs Skaiste together with other prominent senior politicians — Minister of Economy and Finance of France Bruno Le Maire, President of the Eurogroup and Minister of Finance of Ireland Paschal Donohoe or Portuguese Minister of Finance Mario Centeno. Mrs Skaiste’s first months in the position of the Minister of Finance were called by the Magazine as a baptism of fire.

The Minister of Finance also pays great attention to the further development of the Fintech sector in Lithuania. The Fintech sector can be considered Lithuania's “business card”, as the concerted efforts of several successive Governments in this area have created an extremely dynamic Fintech ecosystem. Today's priority is the development and maturity of the sector.

The Ministry of Finance, together with representatives of the market and the public sector, prepared the ambitious Lithuanian Fintech Sector Development Guidelines for the next five years. “We want to be one step ahead of the rest in regulation,” says Mrs Skaiste.

Having started with great energy, Mrs Skaiste has not slowed down the pace during the two years of her term. The most significant initiatives launched include the ambition for Lithuania to become the AMLA competence centre in Europe; the Baltic Capital Markets Development Acceleration Fund – creating a more visible to foreign investors pan-Baltic capital market and increasing the opportunities for SME’s.

The major achievement of Mrs Skaiste – EUR 2 billion plan “New Generation Lithuania” prepared in record time, called by President of the European Commission U. Von der Leyen as excellent, which will play a crucial role in Lithuania’s rise with a stronger economy, accelerating the digital and green transformation. The energy crisis caused by geopolitical challenges has shown that Europe is still significantly dependent on fossil fuels; therefore, strengthening Lithuania's energy independence through investments in renewable energy is one of the features of the plan "New Generation Lithuania". Moreover, the plan for EU Funds’ Investments of almost EUR 8 billion was approved.

Furthermore, even 7 budgets were approved to help people and businesses absorb the shock of inflation and rising energy prices, introducing a wide range of measures worth more than EUR 3.7 billion.

Moreover, Lithuania worked successfully to provide various aid measures to Ukraine for over EUR 900 million or 1.3% of GDP. Finally, in response to geopolitical challenges, funding for national security was increased by 73%, and border control was strengthened with probably the most modern railway X-ray system in the EU.

Mrs Skaiste is also a member of the Lithuanian Riflemen’s Union, an honorary member of the Lithuanian Community of the Atlantic Treaty. In 2016, she was elected a member of the Seimas (Parliament) of the Republic of Lithuania and re-elected in 2020, defeating the then-incumbent representative of the leading party in the county.

Gintarė Skaiste is currently the Minister of Finance of the Republic of Lithuania. She is an economist with a PhD in Social Science.

The Magazine The Banker, a member of the Financial Times publication group, announced G. Skaistė to be the winner of the Finance Minister of the Year (2022) in global and European context. This honourable position is held by Mrs Skaiste together with other prominent senior politicians — Minister of Economy and Finance of France Bruno Le Maire, President of the Eurogroup and Minister of Finance of Ireland Paschal Donohoe or Portuguese Minister of Finance Mario Centeno. Mrs Skaiste’s first months in the position of the Minister of Finance were called by the Magazine as a baptism of fire.

The Minister of Finance also pays great attention to the further development of the Fintech sector in Lithuania. The Fintech sector can be considered Lithuania's “business card”, as the concerted efforts of several successive Governments in this area have created an extremely dynamic Fintech ecosystem. Today's priority is the development and maturity of the sector.

The Ministry of Finance, together with representatives of the market and the public sector, prepared the ambitious Lithuanian Fintech Sector Development Guidelines for the next five years. “We want to be one step ahead of the rest in regulation,” says Mrs Skaiste.

Having started with great energy, Mrs Skaiste has not slowed down the pace during the two years of her term. The most significant initiatives launched include the ambition for Lithuania to become the AMLA competence centre in Europe; the Baltic Capital Markets Development Acceleration Fund – creating a more visible to foreign investors pan-Baltic capital market and increasing the opportunities for SME’s.

The major achievement of Mrs Skaiste – EUR 2 billion plan “New Generation Lithuania” prepared in record time, called by President of the European Commission U. Von der Leyen as excellent, which will play a crucial role in Lithuania’s rise with a stronger economy, accelerating the digital and green transformation. The energy crisis caused by geopolitical challenges has shown that Europe is still significantly dependent on fossil fuels; therefore, strengthening Lithuania's energy independence through investments in renewable energy is one of the features of the plan "New Generation Lithuania". Moreover, the plan for EU Funds’ Investments of almost EUR 8 billion was approved.

Furthermore, even 7 budgets were approved to help people and businesses absorb the shock of inflation and rising energy prices, introducing a wide range of measures worth more than EUR 3.7 billion.

Moreover, Lithuania worked successfully to provide various aid measures to Ukraine for over EUR 900 million or 1.3% of GDP. Finally, in response to geopolitical challenges, funding for national security was increased by 73%, and border control was strengthened with probably the most modern railway X-ray system in the EU.

Mrs Skaiste is also a member of the Lithuanian Riflemen’s Union, an honorary member of the Lithuanian Community of the Atlantic Treaty. In 2016, she was elected a member of the Seimas (Parliament) of the Republic of Lithuania and re-elected in 2020, defeating the then-incumbent representative of the leading party in the county.

-

John Rwangombwa

Governor

National Bank of Rwanda

John Rwangombwa

Governor

Hon. John Rwangombwa was appointed Central Bank Governor on the 25th of February 2023. His career started in Rwanda Revenue Authority where he grew through ranks to the Deputy Commissioner of Customs for Operations. He then joined the Ministry of Finance and Economic Planning in 2002 as the Director of the National Treasury Department.

Having served as the Ministry’s First Accountant General in 2005, Hon. Rwangombwa was appointed Permanent Secretary and Secretary to the Treasury in the same year and in 2009 he became the Minister of Finance and Economic Planning. At that time, he oversaw the elaboration and implementation of Rwanda’s First Economic Development and Poverty Reduction Strategy (EDPRS 1), under which Rwanda’s economy was able to achieve high growth at an average of 8% and poverty was reduced by 12% in 5 years from 2006-2011. Since his appointment as Central Bank Governor to date, Hon. Rwangombwa has been able to maintain the stability of the Rwandan Economy and its Financial Sector. He was voted Governor of the year 2015 for the Sub-Saharan Region by Emerging Markets. Hon. Rwangombwa serves as member of various advisory bodies including the Presidential Advisory Council and World Economic Forum on Global Agenda Council.

-

Mairead McGuinness

Commissioner Financial Services, Financial Stability and Capital Markets Union

European Commission

Mairead McGuinness

Commissioner Financial Services, Financial Stability and Capital Markets Union

Mairead McGuinness is the European Commissioner for financial services, financial stability and Capital Markets Union.

The Commissioner’s vision for the portfolio is focused on ensuring the financial sector’s strength and stability, so that it can deliver for people, society and the environment.

Before joining the Commission in October 2020, Ms McGuinness was First Vice-President of the European Parliament from 2017. She served as an MEP from Ireland for 16 years, and was a Vice-President of the Parliament since 2014.

As Vice-President, she oversaw relations with national Parliaments, led the Parliament’s dialogue with religious and philosophical organisations, and had responsibility for the Parliament’s communication policy.

During her time in the Parliament, Ms McGuinness sat on a range of committees, covering agriculture, environment, public health, budgets, petitions and constitutional affairs. Her legislative work included leading for the EPP Group on the European Climate Law, the revision of medical devices legislation, and CAP reform post-2013. As an Irish MEP representing the border region, she was outspoken on Brexit and the consequences for the EU and Ireland.

In 2006-2007, Ms McGuinness chaired the Parliament’s investigation into the collapse of the Equitable Life assurance company which identified issues around weak financial regulation.

Prior to becoming an MEP, she was an award-winning journalist, broadcaster and commentator.

-

Melissa Guzy

Co-founder & Managing Partner

Arbor Ventures

Melissa Guzy

Co-founder & Managing Partner

Melissa C. Guzy is the Founder and Managing Partner of Arbor Ventures. Before founding of Arbor Ventures, Melissa was a Managing Partner and a member of the Investment Committee at VantagePoint Capital Partners, where she invested in early stage technology companies in Asia, Europe and Silicon Valley. Her current board positions include EverCompliant, Fundbox, InCountry, Tabby, Planck Re and TrueAccord. Melissa was the investor board member of Paidy which was acquired by Paypal for $2.88 billion.

Melissa attended Wellesley College and earned a master’s degree in Finance from the University of Florida. She is the author of the paper “Venture Capital Returns and Public Market Performance.” Melissa is the Co-Chair of the Hong Kong Venture Capital Association (“HKVCA”) Venture Committee, a member of the Board of Directors of the HKVCA and the SVCA and a former member to the Hong Kong SFC on Innovation. Melissa has been recognized as a Top 100 Influencer in Fintech (NxtBnk), AlwaysOn Fintech Power Player, as well as one of the Top 13 Women in Asia of Tech Influencers.

-

Dr Serey Chea

Governor

National Bank of Cambodia

Dr Serey Chea

Governor

Serey Chea is the Governor of National Bank of Cambodia. She is passionate about financial inclusion and women economic empowerment. Achievements under her leadership include the establishment of Credit Bureau Cambodia in 2012 that propelled Cambodia’s Ease of Access to Finance to number 7 worldwide in 2017 by the World Bank, the introduction of Bakong, a national backbone payment system using DLT allowing interoperability amongst all financial service providers making financial services more accessible and affordable, and the introduction of financial literacy into the general education program. Serey hold a PhD in economics and is a member of the Young Global Leaders of the World Economic Forum.

-

Sheel Mohnot

Managing Partner

Better Tomorrow Ventures

Sheel Mohnot

Managing Partner

Sheel Mohnot is Co-Founder and GP of Better Tomorrow Ventures, a seed-stage venture capital fund investing in fintech companies globally. His own startup experience includes 2 successful fintech exits — a payments company and a high-stakes auction company — and he’s GP of the 500 Fintech fund. He formerly worked as a financial services consultant at BCG and started his fintech career at the non-profit p2p lender, Kiva.

-

Shweta Rajpal Kohli

Chief Public Policy Officer

Peak XV Partners

Shweta Rajpal Kohli

Chief Public Policy Officer

As the Head of Public Policy, Shweta works with government stakeholders to craft policies that help accelerate the growth momentum of the startup ecosystem in India & Southeast Asia. She advises portfolio companies on managing regulatory risks and unlocking new levers of growth, and helps create public policy partnerships that align the vision of startup founders and governments.

Before joining Peak XV, Shweta led the public policy function for Salesforce and Uber across South Asia, with a key focus on tech policy, including data privacy, cloud computing regulations, digital payments, and ridesharing regulations.

Shweta is a Board Member of WE-Hub, an accelerator for women entrepreneurs set up by the Telangana Government. She is also the Co-Chair of the Ed-Tech Taskforce set up by industry body FICCI.

Shweta was ranked among IMPACT Magazine’s 50 Most Influential Women in 2018. She received the FICCI FLO Women in Leadership Award in 2020, Women in Excellence Award by the Women Economic Forum in 2019, and the Communicator of the Year by Association of Business Communicators of India (ABCI) in 2011.

Shweta has completed mid-career programs from Wharton Business School, INSEAD Business School, and the University of Westminster. She completed her Bachelors in Journalism from Lady Shri Ram College, holds a Masters in Political Science from Delhi University and a distance learning MBA from XLRI, Jamshedpur.

She was awarded the International Visitor Leadership Program (IVLP) Fellowship, the US Department of State’s professional program for global leaders. A British Chevening Scholar, she was also chosen among 45 global leaders for the Asian Forum on Global Governance (AFGG) Fellowship.

Before joining the policy world, Shweta spent two decades as a business journalist and TV news anchor. During her journalism career, she received several honours, including the Ramnath Goenka Journalism Award for Broadcast Journalism by President of India Pratibha Patil and Business Standard-Seema Nazareth Award for Young Print Journalists by President of India KR Narayanan.

Shweta is a regular speaker at leading conferences, including World Economic Forum India Summit, MindMine Summit, CyFy India, and the UN Gender Equality Summit.

She lives in New Delhi with her husband and two children.

(e): shweta@peakxv.com (T): @ShwetaRKohli (m): +91-9899888667

-

Sigal Mandelker

Ribbit Capital

Sigal Mandelker

Sigal Mandelker joined Ribbit Capital in April 2020. Ribbit is an investment firm focused on financial services and technology. Prior to Ribbit, she served as Under Secretary of Treasury for Terrorism and Financial Intelligence and as Acting Deputy Secretary. As Under Secretary, Sigal supervised four main components of Treasury (OFAC, FinCEN, the Office of Intelligence and Analysis, and the Office of Terrorist Financing and Financial Crimes). Before serving at Treasury, Sigal was a partner at Proskauer in New York. Sigal also previously served in a number of senior positions in the U.S. government, including as Deputy Assistant Attorney General in the Criminal Division of the Justice Department, an AUSA in the U.S. Attorney’s Office for the Southern District of New York, Counselor to Secretary of Homeland Security Michael Chertoff, and Counsel to the Deputy Attorney General. Sigal is also an Advisor to Chainalysis, is on the Boards of the Crypto Council for Innovation and the Financial Technology Association, is Co-Chair of the Center for a New American Security’s (CNAS) task force on FinTech, Crypto, and National Security, is a Member of the US Holocaust Memorial Museum Council, and Chair of the US Holocaust Memorial Museum's Collections & Acquisitions Committee.

Ajay Banga

President

World Bank

Ajay Banga began his five-year term as World Bank President on June 2, 2023.

Immediately before, Ajay served as Vice Chairman at General Atlantic and previously was President and CEO of Mastercard. Under his leadership, MasterCard launched the Center for Inclusive Growth, which advances equitable and sustainable economic growth and financial inclusion around the world.

Ajay was Honorary Chairman of the International Chamber of Commerce from 2020-2022. And served as advisor to General Atlantic’s climate-focused fund, BeyondNetZero, at its inception in 2021.

Additionally, Ajay Co-Chaired the Partnership for Central America, a coalition of private organizations that works to advance economic opportunity across underserved populations in El Salvador, Guatemala, and Honduras. He also served on the Boards of the American Red Cross, Kraft Foods, and Dow Inc.

Ajay is a co-founder of The Cyber Readiness Institute and was Vice Chair of the Economic Club of New York. He was awarded the Foreign Policy Association Medal in 2012, the Padma Shri Award by the President of India in 2016, the Ellis Island Medal of Honor and the Business Council for International Understanding’s Global Leadership Award in 2019, and the Distinguished Friends of Singapore Public Service Star in 2021.

Anil Wadhwani

Chief Executive Officer

Prudential plc

As Chief Executive Officer, Anil leads Prudential plc’s operations in Asia and Africa, overseeing a 15,000-strong team in 24 markets.

He joined Prudential in 2023 with a passion for helping customers, their families and communities secure their future through innovative solutions. Anil is based in Hong Kong.

Anil has more than 30 years’ financial services experience, predominantly in Asia. Born and educated in Mumbai, he has lived and worked in India, Singapore, London, New York and Hong Kong.

Prior to joining Prudential, Anil was CEO of Manulife Asia, where he spent five years growing the multi-channel organisation and transforming its highly diversified business with significant market share gains.

Anil also spent 25 years with Citigroup Inc in Asia Pacific, EMEA and the US in a number of consumer financial services roles.

Throughout his career Anil has combined strategic vision and meticulous execution to drive the performance of leading companies. He has also led significant digital transformation, having overseen the modernisation of technology platforms in previous roles.

Anil holds a Master’s Degree in Management Studies from the Somaiya Institute of Management Studies and a Bachelor’s Degree in Commerce from the Narsee Monjee College of Commerce and Economics in Mumbai.

Hon Caroline D. Pham

Commissioner

U.S. Commodity Futures Trading Commission

The Honorable Caroline D. Pham was sworn in as a CFTC Commissioner on April 14, 2022. Commissioner Pham is a recognized leader in financial services compliance and regulatory strategy and policy. Her substantial experience spans key international issues such as prudential regulation and systemic risk, financial markets, fintech and digital assets, ESG, implementation of global regulatory reforms, and addressing the impact of major disruptions like the 2008 financial crisis and the COVID-19 pandemic. Commissioner Pham is the sponsor of the CFTC’s Global Markets Advisory Committee.

Previously, Commissioner Pham was a Managing Director at Citigroup where she held various senior roles, including Head of Market Structure for Strategic Initiatives on the Institutional Clients Group Business Development team; Head of Capital Markets Regulatory Strategy and Engagement; Deputy Head of Global Regulatory Affairs; and Global Head of Swap Dealer and Volcker Compliance. She was a member of firmwide governance forums and has held leadership roles in many industry organizations.

Commissioner Pham is a Fellow of the American Bar Foundation and has received various professional awards. She has a B.A. from UCLA and a J.D. from the George Washington University Law School, where she has served on the Dean’s Advisory Council for Business and Finance Law and was a Visiting Fellow at the Center for Law, Economics and Finance.

Professor Eswar Prasad

Professor

Cornell University

Eswar Prasad is the Tolani Senior Professor of Trade Policy and Professor of Economics at Cornell University. He is also a Senior Fellow at the Brookings Institution, where he holds the New Century Chair in International Economics, and a Research Associate at the National Bureau of Economic Research. He was previously chief of the Financial Studies Division in the IMF’s Research Department and, before that, was the head of the IMF’s China Division.

Prasad’s latest book is The Future of Money: How the Digital Revolution is Transforming Currencies and Finance (Harvard University Press, 2021), which was listed among the best economics books of 2021 by the Economist, the Financial Times and Foreign Affairs. He is also the author of Gaining Currency: The Rise of the Renminbi (Oxford, 2016) and The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global Finance (Princeton, 2014). Prasad has testified before the Senate Finance Committee, the House of Representatives Committee on Financial Services, and the U.S.-China Economic and Security Review Commission. He is the creator of the Brookings-Financial Times world economy index (TIGER: Tracking Indices for the Global Economic Recovery). His op-ed articles have appeared in the Financial Times, Foreign Policy, Harvard Business Review, New York Times, Wall Street Journal, and Washington Post.

François Villeroy de Galhau

Governor

Banque de France

1959 - Naissance à Strasbourg

1997 - Head of Cabinet, French Ministry of Finance

2000 - General Manager Tax Department, French Ministry of Finance

2003 - CEO Cetelem

2011 - Deputy General Manager BNP Paribas Group

2015 - Governor of Banque de France

Gintare Skaiste

Minister of Finance

Republic of Lithuania

Gintarė Skaiste is currently the Minister of Finance of the Republic of Lithuania. She is an economist with a PhD in Social Science.

The Magazine The Banker, a member of the Financial Times publication group, announced G. Skaistė to be the winner of the Finance Minister of the Year (2022) in global and European context. This honourable position is held by Mrs Skaiste together with other prominent senior politicians — Minister of Economy and Finance of France Bruno Le Maire, President of the Eurogroup and Minister of Finance of Ireland Paschal Donohoe or Portuguese Minister of Finance Mario Centeno. Mrs Skaiste’s first months in the position of the Minister of Finance were called by the Magazine as a baptism of fire.

The Minister of Finance also pays great attention to the further development of the Fintech sector in Lithuania. The Fintech sector can be considered Lithuania's “business card”, as the concerted efforts of several successive Governments in this area have created an extremely dynamic Fintech ecosystem. Today's priority is the development and maturity of the sector.

The Ministry of Finance, together with representatives of the market and the public sector, prepared the ambitious Lithuanian Fintech Sector Development Guidelines for the next five years. “We want to be one step ahead of the rest in regulation,” says Mrs Skaiste.

Having started with great energy, Mrs Skaiste has not slowed down the pace during the two years of her term. The most significant initiatives launched include the ambition for Lithuania to become the AMLA competence centre in Europe; the Baltic Capital Markets Development Acceleration Fund – creating a more visible to foreign investors pan-Baltic capital market and increasing the opportunities for SME’s.

The major achievement of Mrs Skaiste – EUR 2 billion plan “New Generation Lithuania” prepared in record time, called by President of the European Commission U. Von der Leyen as excellent, which will play a crucial role in Lithuania’s rise with a stronger economy, accelerating the digital and green transformation. The energy crisis caused by geopolitical challenges has shown that Europe is still significantly dependent on fossil fuels; therefore, strengthening Lithuania's energy independence through investments in renewable energy is one of the features of the plan "New Generation Lithuania". Moreover, the plan for EU Funds’ Investments of almost EUR 8 billion was approved.

Furthermore, even 7 budgets were approved to help people and businesses absorb the shock of inflation and rising energy prices, introducing a wide range of measures worth more than EUR 3.7 billion.

Moreover, Lithuania worked successfully to provide various aid measures to Ukraine for over EUR 900 million or 1.3% of GDP. Finally, in response to geopolitical challenges, funding for national security was increased by 73%, and border control was strengthened with probably the most modern railway X-ray system in the EU.

Mrs Skaiste is also a member of the Lithuanian Riflemen’s Union, an honorary member of the Lithuanian Community of the Atlantic Treaty. In 2016, she was elected a member of the Seimas (Parliament) of the Republic of Lithuania and re-elected in 2020, defeating the then-incumbent representative of the leading party in the county.

Gintarė Skaiste is currently the Minister of Finance of the Republic of Lithuania. She is an economist with a PhD in Social Science.

The Magazine The Banker, a member of the Financial Times publication group, announced G. Skaistė to be the winner of the Finance Minister of the Year (2022) in global and European context. This honourable position is held by Mrs Skaiste together with other prominent senior politicians — Minister of Economy and Finance of France Bruno Le Maire, President of the Eurogroup and Minister of Finance of Ireland Paschal Donohoe or Portuguese Minister of Finance Mario Centeno. Mrs Skaiste’s first months in the position of the Minister of Finance were called by the Magazine as a baptism of fire.

The Minister of Finance also pays great attention to the further development of the Fintech sector in Lithuania. The Fintech sector can be considered Lithuania's “business card”, as the concerted efforts of several successive Governments in this area have created an extremely dynamic Fintech ecosystem. Today's priority is the development and maturity of the sector.

The Ministry of Finance, together with representatives of the market and the public sector, prepared the ambitious Lithuanian Fintech Sector Development Guidelines for the next five years. “We want to be one step ahead of the rest in regulation,” says Mrs Skaiste.

Having started with great energy, Mrs Skaiste has not slowed down the pace during the two years of her term. The most significant initiatives launched include the ambition for Lithuania to become the AMLA competence centre in Europe; the Baltic Capital Markets Development Acceleration Fund – creating a more visible to foreign investors pan-Baltic capital market and increasing the opportunities for SME’s.

The major achievement of Mrs Skaiste – EUR 2 billion plan “New Generation Lithuania” prepared in record time, called by President of the European Commission U. Von der Leyen as excellent, which will play a crucial role in Lithuania’s rise with a stronger economy, accelerating the digital and green transformation. The energy crisis caused by geopolitical challenges has shown that Europe is still significantly dependent on fossil fuels; therefore, strengthening Lithuania's energy independence through investments in renewable energy is one of the features of the plan "New Generation Lithuania". Moreover, the plan for EU Funds’ Investments of almost EUR 8 billion was approved.

Furthermore, even 7 budgets were approved to help people and businesses absorb the shock of inflation and rising energy prices, introducing a wide range of measures worth more than EUR 3.7 billion.

Moreover, Lithuania worked successfully to provide various aid measures to Ukraine for over EUR 900 million or 1.3% of GDP. Finally, in response to geopolitical challenges, funding for national security was increased by 73%, and border control was strengthened with probably the most modern railway X-ray system in the EU.

Mrs Skaiste is also a member of the Lithuanian Riflemen’s Union, an honorary member of the Lithuanian Community of the Atlantic Treaty. In 2016, she was elected a member of the Seimas (Parliament) of the Republic of Lithuania and re-elected in 2020, defeating the then-incumbent representative of the leading party in the county.

John Rwangombwa

Governor

National Bank of Rwanda

Hon. John Rwangombwa was appointed Central Bank Governor on the 25th of February 2023. His career started in Rwanda Revenue Authority where he grew through ranks to the Deputy Commissioner of Customs for Operations. He then joined the Ministry of Finance and Economic Planning in 2002 as the Director of the National Treasury Department.

Having served as the Ministry’s First Accountant General in 2005, Hon. Rwangombwa was appointed Permanent Secretary and Secretary to the Treasury in the same year and in 2009 he became the Minister of Finance and Economic Planning. At that time, he oversaw the elaboration and implementation of Rwanda’s First Economic Development and Poverty Reduction Strategy (EDPRS 1), under which Rwanda’s economy was able to achieve high growth at an average of 8% and poverty was reduced by 12% in 5 years from 2006-2011. Since his appointment as Central Bank Governor to date, Hon. Rwangombwa has been able to maintain the stability of the Rwandan Economy and its Financial Sector. He was voted Governor of the year 2015 for the Sub-Saharan Region by Emerging Markets. Hon. Rwangombwa serves as member of various advisory bodies including the Presidential Advisory Council and World Economic Forum on Global Agenda Council.

Mairead McGuinness

Commissioner Financial Services, Financial Stability and Capital Markets Union

European Commission

Mairead McGuinness is the European Commissioner for financial services, financial stability and Capital Markets Union.

The Commissioner’s vision for the portfolio is focused on ensuring the financial sector’s strength and stability, so that it can deliver for people, society and the environment.

Before joining the Commission in October 2020, Ms McGuinness was First Vice-President of the European Parliament from 2017. She served as an MEP from Ireland for 16 years, and was a Vice-President of the Parliament since 2014.

As Vice-President, she oversaw relations with national Parliaments, led the Parliament’s dialogue with religious and philosophical organisations, and had responsibility for the Parliament’s communication policy.

During her time in the Parliament, Ms McGuinness sat on a range of committees, covering agriculture, environment, public health, budgets, petitions and constitutional affairs. Her legislative work included leading for the EPP Group on the European Climate Law, the revision of medical devices legislation, and CAP reform post-2013. As an Irish MEP representing the border region, she was outspoken on Brexit and the consequences for the EU and Ireland.

In 2006-2007, Ms McGuinness chaired the Parliament’s investigation into the collapse of the Equitable Life assurance company which identified issues around weak financial regulation.

Prior to becoming an MEP, she was an award-winning journalist, broadcaster and commentator.

Melissa Guzy

Co-founder & Managing Partner

Arbor Ventures

Melissa C. Guzy is the Founder and Managing Partner of Arbor Ventures. Before founding of Arbor Ventures, Melissa was a Managing Partner and a member of the Investment Committee at VantagePoint Capital Partners, where she invested in early stage technology companies in Asia, Europe and Silicon Valley. Her current board positions include EverCompliant, Fundbox, InCountry, Tabby, Planck Re and TrueAccord. Melissa was the investor board member of Paidy which was acquired by Paypal for $2.88 billion.

Melissa attended Wellesley College and earned a master’s degree in Finance from the University of Florida. She is the author of the paper “Venture Capital Returns and Public Market Performance.” Melissa is the Co-Chair of the Hong Kong Venture Capital Association (“HKVCA”) Venture Committee, a member of the Board of Directors of the HKVCA and the SVCA and a former member to the Hong Kong SFC on Innovation. Melissa has been recognized as a Top 100 Influencer in Fintech (NxtBnk), AlwaysOn Fintech Power Player, as well as one of the Top 13 Women in Asia of Tech Influencers.

Dr Serey Chea

Governor

National Bank of Cambodia

Serey Chea is the Governor of National Bank of Cambodia. She is passionate about financial inclusion and women economic empowerment. Achievements under her leadership include the establishment of Credit Bureau Cambodia in 2012 that propelled Cambodia’s Ease of Access to Finance to number 7 worldwide in 2017 by the World Bank, the introduction of Bakong, a national backbone payment system using DLT allowing interoperability amongst all financial service providers making financial services more accessible and affordable, and the introduction of financial literacy into the general education program. Serey hold a PhD in economics and is a member of the Young Global Leaders of the World Economic Forum.

Sheel Mohnot

Managing Partner

Better Tomorrow Ventures

Sheel Mohnot is Co-Founder and GP of Better Tomorrow Ventures, a seed-stage venture capital fund investing in fintech companies globally. His own startup experience includes 2 successful fintech exits — a payments company and a high-stakes auction company — and he’s GP of the 500 Fintech fund. He formerly worked as a financial services consultant at BCG and started his fintech career at the non-profit p2p lender, Kiva.

Shweta Rajpal Kohli

Chief Public Policy Officer

Peak XV Partners

As the Head of Public Policy, Shweta works with government stakeholders to craft policies that help accelerate the growth momentum of the startup ecosystem in India & Southeast Asia. She advises portfolio companies on managing regulatory risks and unlocking new levers of growth, and helps create public policy partnerships that align the vision of startup founders and governments.

Before joining Peak XV, Shweta led the public policy function for Salesforce and Uber across South Asia, with a key focus on tech policy, including data privacy, cloud computing regulations, digital payments, and ridesharing regulations.

Shweta is a Board Member of WE-Hub, an accelerator for women entrepreneurs set up by the Telangana Government. She is also the Co-Chair of the Ed-Tech Taskforce set up by industry body FICCI.

Shweta was ranked among IMPACT Magazine’s 50 Most Influential Women in 2018. She received the FICCI FLO Women in Leadership Award in 2020, Women in Excellence Award by the Women Economic Forum in 2019, and the Communicator of the Year by Association of Business Communicators of India (ABCI) in 2011.

Shweta has completed mid-career programs from Wharton Business School, INSEAD Business School, and the University of Westminster. She completed her Bachelors in Journalism from Lady Shri Ram College, holds a Masters in Political Science from Delhi University and a distance learning MBA from XLRI, Jamshedpur.

She was awarded the International Visitor Leadership Program (IVLP) Fellowship, the US Department of State’s professional program for global leaders. A British Chevening Scholar, she was also chosen among 45 global leaders for the Asian Forum on Global Governance (AFGG) Fellowship.

Before joining the policy world, Shweta spent two decades as a business journalist and TV news anchor. During her journalism career, she received several honours, including the Ramnath Goenka Journalism Award for Broadcast Journalism by President of India Pratibha Patil and Business Standard-Seema Nazareth Award for Young Print Journalists by President of India KR Narayanan.

Shweta is a regular speaker at leading conferences, including World Economic Forum India Summit, MindMine Summit, CyFy India, and the UN Gender Equality Summit.

She lives in New Delhi with her husband and two children.

(e): shweta@peakxv.com (T): @ShwetaRKohli (m): +91-9899888667

Sigal Mandelker

Ribbit Capital

Sigal Mandelker joined Ribbit Capital in April 2020. Ribbit is an investment firm focused on financial services and technology. Prior to Ribbit, she served as Under Secretary of Treasury for Terrorism and Financial Intelligence and as Acting Deputy Secretary. As Under Secretary, Sigal supervised four main components of Treasury (OFAC, FinCEN, the Office of Intelligence and Analysis, and the Office of Terrorist Financing and Financial Crimes). Before serving at Treasury, Sigal was a partner at Proskauer in New York. Sigal also previously served in a number of senior positions in the U.S. government, including as Deputy Assistant Attorney General in the Criminal Division of the Justice Department, an AUSA in the U.S. Attorney’s Office for the Southern District of New York, Counselor to Secretary of Homeland Security Michael Chertoff, and Counsel to the Deputy Attorney General. Sigal is also an Advisor to Chainalysis, is on the Boards of the Crypto Council for Innovation and the Financial Technology Association, is Co-Chair of the Center for a New American Security’s (CNAS) task force on FinTech, Crypto, and National Security, is a Member of the US Holocaust Memorial Museum Council, and Chair of the US Holocaust Memorial Museum's Collections & Acquisitions Committee.

Learning Village

Who's Coming

FINTECH PROFESSIONALS LOOKING TO UPSKILL

STUDENTS EXPLORING FINTECH CAREERS

RECRUITERS (COMPANIES)

RECRUITERS (AGENCIES)

RECRUITERS (UNIVERSITIES)

EMPLOYERS IN THE FINTECH SECTOR

CAREER MENTORS AND COACHES

HR PROFESSIONALS IN THE FINANCIAL SECTOR

The Festival

Get Involved

Global Platforms